Let us look at overshoot day from the point of view of economics. By economics I mean the technology of keeping track of housekeeping with resources and keeping track of material obligations to those around us. Economics does not need to be restricted to counting with money. Other measures can be used. And it is fascinating to try it. In this case we can consider that a Nation has its own household that it needs to keep fed and housed, and has its natural resources to do it. We start with a situation however where many nations are living over their means.

As the Overshoot website explains:

August 20 is Earth Overshoot Day 2013, marking the date when humanity exhausted nature’s budget for the year. We are now operating in overdraft. For the rest of the year, we will maintain our ecological deficit by drawing down local resource stocks and accumulating carbon dioxide in the atmosphere.

Just as a bank statement tracks income against expenditures, Global Footprint Network measures humanity’s demand for and supply of natural resources and ecological services. And the data is sobering. Global Footprint Network estimates that in approximately eight months, we demand more renewable resources and C02 sequestration than what the planet can provide for an entire year.

Suppose we were to mirror conventional accounting practice.

Starting with GDP, gross domestic product and debt to GDP ratio.

‘Debt-To-GDP Ratio’

The measure gives an idea of the ability of a country to make future payments on its debt. If a country were unable to pay its debt, it would default, which could cause a panic in the domestic and international markets. The higher the debt-to-GDP ratio, the less likely the country will pay its debt back, and the higher its risk of default.

‘Debt-To-Gross Domestic Natural Outtake Ratio’

We can use the GDP idea to reflect the total outtake by economic activities on the natural resources in the particular nation. Lets call it Gross Natural Product and call it GUP in order to not confuse it with GNP.

If there are 365 days in the year, then overshoot happened on day 232 of 365. Our Debt to GUP ratio is therefore 133 days to 365 or 36%.

This represents a general average of all countries. Some have a higher Debt Ratio than others. As some countries use other’s resources there is also a balance of outtake between nations. Some give their outtake to other nations, for example.

Paying it back?

If debts are not paid back and allowed to increase, conventional economics tell us we get into a bubble situation.

Debt-to-GDP measures the financial leverage of an economy; some economists, such as Steve Keen, advocate using it as the key measure of a credit bubble (both its level and its change – particularly of private debt and total debt), and high levels of government debt (public debt) are widely decried as fiscal irresponsibility. [Wikipedia]

BUBBLES

The term “bubble”, in reference to financial crisis, originated in the 1711–1720 British South Sea Bubble, and originally referred to the companies themselves, and their inflated stock, rather than to the crisis itself. This was one of the earliest modern financial crises; other episodes were referred to as “manias”, as in the Dutch tulip mania. The metaphor indicated that the prices of the stock were inflated and fragile – expanded based on nothing but air, and vulnerable to a sudden burst, as in fact occurred. [Wikipedia]

In the case of GUP – the excessive outtake of natural resources represents a bubble in that we place a value on the outtake itself that is widely inflated. In real terms it means that we assume we can go on drawing down resources and that there will be no price to pay. But there will.

How can we calculate the impact of a burst bubble?

Before we consider this question, let us consider

What does paying back overshot outtake really entail?

Two things depending on if you are talking minerals or biomass.

Minerals

if we intend to use minerals indefinitely when there is an indefinite supply, to invest in recycling.

Biomass and natural cycles

In natural cycles, overshoot means two things

1) we create a congestion in places the nutrients should not be. For example, in itself there is nothing wrong with carbon dioxide, but accumulating in the atmosphere can upset the climate system. Paying back simply means redressing the imbalance and removing congestion.

2) that the production capacity per capita of nature is disturbed. We do this in two ways. Firstly, we grow in numbers. Without doing anything else we reduce the production per capital. Secondly, we reduce the ecological maturity of the ecosystems we live in. Less mature systems have lower production capacity.

As you see from the diagram below, representing Sweden, the net capacity available to the country has reduced even though its own footprint, or outtake has remained steady.

(diagram courtesy of http://www.footprintnetwork.org)

Of course stopping the burning of fossil fuels is easier said than done. So we might be looking at some kind of problem in redressing the balance. This leads us to the next problem: what would a burst of the natural bubble look like?

This is where we need to work with the risk involved. And there is no point in trying to calculate it in money. Let’s take it simpler than that.

Lets create a scoring system based on the percentage of people in a nation who can get food and shelter. We can call it the WFS %, short for Water, Food, Shelter.

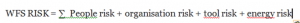

To deliver water, food and shelter requires competent people, an efficient organisation, appropriate tools and energy to run them. And it is a simple measure. Either you have enough or you don’t. If you don’t have enough land to produce food you cannot compensate with more people. So the RISK to WFS security is the aggregate of the risk of not having sufficient conditions.

The bubble comes from the investment in food and house production systems that rely on the high outtake model. The bubble bursts when the system fails to work and people go hungry and homeless.

A lot of work has been done on these risks, too much to analyse in this post. I leave the reader to start to consider the size of the risks to their “household”.

Leave a Reply